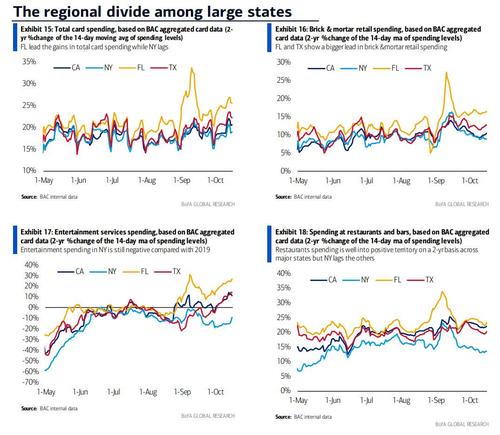

Last week we explained why the widely propagated myth that there is north of $2 trillion in “excess cash” savings spread evenly across the US population courtesy of Biden’s trillions, was nothing but a fake pipe dream: as we showed then when looking at cash holdings (checkable deposits and currency) from 1Q20-1Q21 across the income distribution, 65% of excess cash (cash accumulated above the 4Q19 level) is held among the top 20%, while just 35% was spread across the entire bottom 80% (the top 80% holds ~$1.4tn in excess savings and bottom 80% holds ~$800bn).

And in light of the recent feverish pace of consumer spending among the bottom 80%, we also said that much if not all of these cash savings had been spent.

Overnight, Bank of America indirectly confirmed this.

When looking at its latest debt and credit cars spending data, BofA chief economist Michelle Meyer observed that spending on credit cards among the lower income cohort has spiked with a 23% growth rate over a 2-year period, up from the summer average of 15%. Read more…